How AI is impacting the accounting and finance sector

As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting communities and did so yet again in 2023. As ChatGPT swept the world, the institute asked leaders from hundreds of accounting firms and corporate tax departments across the United States, Canada and United Kingdom to share their thoughts on the tool and the technology driving it1.

To say the results were interesting would be an understatement.

Almost 75% of tax professionals acknowledged generative AI could be used for tax, accounting and audit work – but only about 50% believed it should be. Only 15% of surveyed firms were currently using AI or planning to adopt it soon – and 73% of respondents had no current plans to use the technology2.

Then there were the comments. "[Generative] AI is not actual intelligence — it’s textual crowd-sourcing,” said one respondent, while another declared: “The technology will never reach the equivalent of a talented professional in terms of planning and technical expertise."3

That may be true but what can be said with certainty is that artificial intelligence is here to stay and that is why the likes of the ‘Big 4’ accounting firms – Deloitte, PWC, Ernst & Young and KPMG – are leading the way with its adoption4. They are investing heavily in AI-powered tools and solutions to not only gain an edge for their clients but in a bid to outshine their competitors in the technology arms race.

They are not alone though, with smaller accounting firms also realizing there is a lot to like about a technology that can deliver untold benefits for their customers and staff alike. For those still debating its merits, this blog is designed to shine a spotlight on how to best leverage AI in accounting and finance, highlight the challenges of adopting such technology and reflect on how it will impact jobs in the future.

The role of AI in finance and accounting

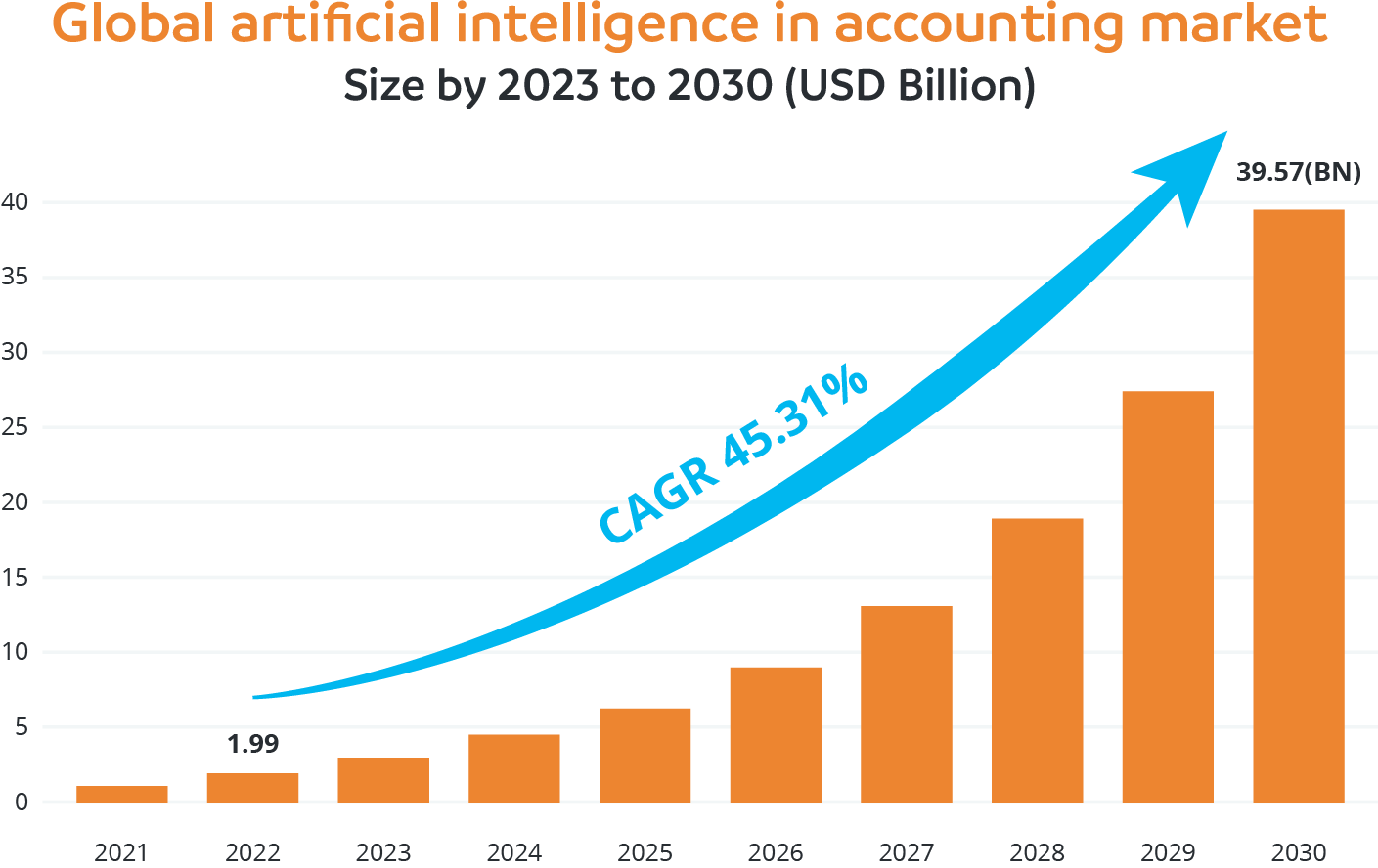

AI in accounting and finance is the use of artificial intelligence technologies to automate and enhance various processes. This includes the likes of machine learning algorithms and natural language processing to tackle tasks such as financial reporting, audit and compliance, fraud detection and data analysis. Mordor Intelligence estimates AI in the accounting market is already worth $1.56 billion and is tipping that to grow to $6.62 billion by 20295.

Source: Artificial Intelligence in Accounting Market Report 2023-2030 (snsinsider.com)

How to leverage AI in finance and accounting

ChatGPT may have wowed the world when it was launched in late 2022 but there are various ways that generative AI tools and solutions are changing the accountants and financial controllers.

- Predictive analytics: data is king in 2024 and generative AI is allowing accounting and finance firms to tap into that information like never before. The technology can learn from historical financial data and, in turn, capture complex patterns that allow them to make quality predictions about future trends and economic indicators. This includes simulating market conditions and other variables to generate scenarios that can provide insights into both risks and opportunities.

- Auditing: accountants have long dreamed of finding a way to analyze large volumes of financial data faster without sacrificing quality. AI-powered audit tools are making that dream a reality by processing, summarizing and extracting valuable information from the likes of annual reports, financial statements and earnings calls, which ultimately leads to more efficient and accurate auditing and decision-making.

- Tax compliance: ask any accountant about the bugbears of their roles and many will put ever-changing tax codes and regulations near the top of the list. Staying abreast of such changes is essential to ensure adherence to strict tax codes and regulations, which is why many of those accountants are increasingly grateful for AI tools that automate complex compliance tasks.

- Fraud detection: it is a fact of business life that not all businesses will play by the taxation and record-keeping rulebook, which can make life difficult for accounting firms committed to legal and ethical frameworks. Recent years have seen generative AI used to generate synthetic examples of fraudulent transactions that can then help train and augment machine learning algorithms to recognize and differentiate between legitimate and fraudulent patterns in financial data.

What are the benefits of AI in accounting?

In an industry where many practitioners would rather be advisors than data processors, AI offers many benefits including:

- Time savings: routine and time-consuming tasks are a fact of life for accounting firms but AI is increasingly taking care of them and allowing team members to focus on more strategic activities.

- Scalability: juggling resources for peak and quiet periods has long been a headache for accounting leaders (tax season anyone?) but AI is helping firms scale up and down without significantly increasing workforce numbers.

- Happier clients: the data-driven insights provided by AI-powered tools is playing a key role in fostering stronger relationships between accountants and the clients they serve.

The challenges of adopting AI in accounting

Before rushing to embrace AI in accounting, it pays to be aware of several barriers that need to be monitored or addressed.

- Staff resistance: for all the talk of increased efficiencies and improved productivity, there will inevitably be employees who fear modern technologies. Any AI in accounting rollout should be accompanied by a concerted effort to get positive buy-in from executives and influential team members.

- Data limitations: the ‘Big 4’ may have no concerns collecting sufficient data to build AI models but that may not be the case for smaller accounting firms. It can be expensive to collect and house the necessary data but it will be worth it in the long run.

- Data security: while the AI boom is delivering many benefits to the accounting and finance sector, it has also created an environment that is particularly enticing to cyber criminals. One of the great fears for any firm is exposing clients’ personal data to misuse, which is why any investment in AI needs to be accompanied by a similar investment in cybersecurity measures.

Summary

The days of fearing AI in the accounting and finance sector are over. Rather than viewing it as a threat, forward-thinking firms are realizing it has the potential to empower them to offer better insights, improve efficiencies, save time and ultimately stay ahead of competitors.

Just as many accounting firms are adopting AI-powered tools, many businesses are looking offshore for the right teams and individuals to meet their needs. Discover how to change your business for the better with this complete guide into the world of outsourced finance and accounting.

Reference:

[1] ChatGPT-in-Tax-Report-2023.pdf (thomsonreuters.com)

[2] How are different accounting firms using AI? (thomsonreuters.com)

[3] ChatGPT-in-Tax-Report-2023.pdf (thomsonreuters.com)

[4] (22) The largest accounting firms – EY, Deloitte, KPMG, and PwC – are investing billions of dollars in artificial intelligence (AI). Why? | LinkedIn

[5] AI in Accounting Market - Size, Trends & Industry Analysis (mordorintelligence.com)

Popular posts

Browse by topic

- Accounting

- Accounting & Finance

- All Industries

- Banking

- BPO/RPO/HRO

- Communication

- CSR & ESG

- Customer & Client Acquisition

- Customer Experience

- Cybersecurity

- Cybersecurity & Compliance

- Data Management

- Digital Operations

- Digital Transformation

- eCommerce

- Education

- Employee Engagement

- Engineering & Construction

- Financial Services

- Healthcare

- Hospitality and tourism

- HR & Recruitment

- Information Technology

- Insurance

- Legal Services

- Logistics

- Offshoring & Outsourcing

- Outsourcing

- Professional Services

- Real Estate

- Retail & eCommerce

- Startups

- Talent Acquisition and Retention

- Technology

- Trends & Guides

- Workforce Integration

Related Posts

How employers can reduce healthcare costs

A lot has been written about how the working world has changed in the wake of the COVID-19 pandemic. Where many managers once linked productivity..

How Insurance Firms Benefit from Outsourcing Amid Industry Challenges

Insurance executives could be excused for feeling an extra weight on their shoulders were they to glance at McKinsey & Company’s latest insight into..

The ultimate guide to outsourcing data processing services

For more than a century, Harvard Business Review has been a go-to resource for managers wanting insights into topics such as leadership, negotiation,..