How to outsource accounting services

There is no shortage of anecdotal evidence to suggest accountancy outsourcing is on the rise but a recently released study has revealed just how significant that rise is. The respected industry publication Accountancy Age reported that global spending on outsourced accounting has increased almost 40% during the past five years, with one insider comparing the growing demand to the revolutionary impact of generative AI1.

“The surge in popularity is because people are looking for high levels of service at a cost-effective price point,” they said. “Add to this the lack of a strong pipeline of talent coming through and it’s understandable to see outsourcing swiftly gaining momentum.”

The boom is partly being driven by the transition to cloud-based accounting, which has removed the need for accountants or bookkeepers to attend a business’s physical location.

As noted by business news outlet Forbes: “Traditionally, the accounting department wasn’t a function in a business that could be outsourced (as) the pervasive nature of business accounting makes it hard to extract that function from operations. However, in the current digital world, especially one focused on services, there are various ways a small business can outsource the accounting department.”2

It is one thing to know outsourcing accounting services is a smart move. It is another to make the transition with confidence. To assist businesses of all sizes, this guide will shine a spotlight on the benefits of accountancy outsourcing, showcase organizations that utilize the service and provide tips for successfully implementing an outsourcing strategy.

Content guide

- What roles can be outsourced in the accounting sector?

- What organizations can benefit from outsourcing accounting services?

- What are the benefits of outsourcing accounting services?

- How do you pursue an outsourced accounting strategy?

- What staffing options are available for outsourced accounting teams?

- What are examples of an outsourced accounting team structure?

- What are tips for partnering with outsourced accounting providers in the Philippines?

What are outsourced accounting services?

Outsourced accounting services involve engaging a third-party provider to perform certain accounting or finance tasks that would otherwise be done onshore. Such roles include data analysts, bookkeepers, accountants and accounts receivable and payable specialists and they can free up time for in-house teams to perform higher value activities and focus on nurturing client relationships.

Source: Outsource Accounting to Make Your Business More Efficient (sleek.com)

What roles can be outsourced in the accounting sector?

There are no shortage of accounting and finance roles that can be outsourced. They include:

- Accountants

- Accounts receivable specialists

- Accounts payable specialists

- Administrative assistants

- Bookkeepers

- Broker support officers

- Debt collection specialists

- Financial advisors

- Financial analysts

- Insurance claims processors

- Loan processors

- Payroll processors

- Procurement officers

- Tax advisors

What organizations can benefit from outsourcing accounting services?

Outsourcing accounting services was traditionally the domain of large corporations but cutting-edge technology and a rise in remote work means almost any organization can now reap the rewards of partnering with offshore partners.

-

Small businesses:

while small business owners may be able to justify employing a bookkeeper or office manager, there is no need for a full-time accountant or chief financial officer. Outsourcing allows them to tap into such expertise without outlaying significant wages. -

Businesses in tight labor markets:

like any sector, accounting is impacted by access to talent and there are often times when it can be difficult for businesses to recruit quality staff. Outsourcing to a quality provider negates this factor. -

Not-for-profit organizations:

businesses can find outlaying wages for accounting staff a challenge. Now spare a thought for not-for-profits and charities. Outsourcing allows such organizations to access specialists in the sector without committing to full-time salaries. -

Growth businesses:

for all the thrills of being a growing business, it can be incredibly difficult for owners and managers to know when to bolster their accounting credentials. Partnering with an outsourcing provider is ideal for expanding such capabilities in a measured way. -

Businesses in temporary need:

for many businesses, accounting is a seasonal requirement (eg: end-of-year reporting). Similarly, there are times when they need a short-term replacement. Outsourcing is a great option for such organizations.

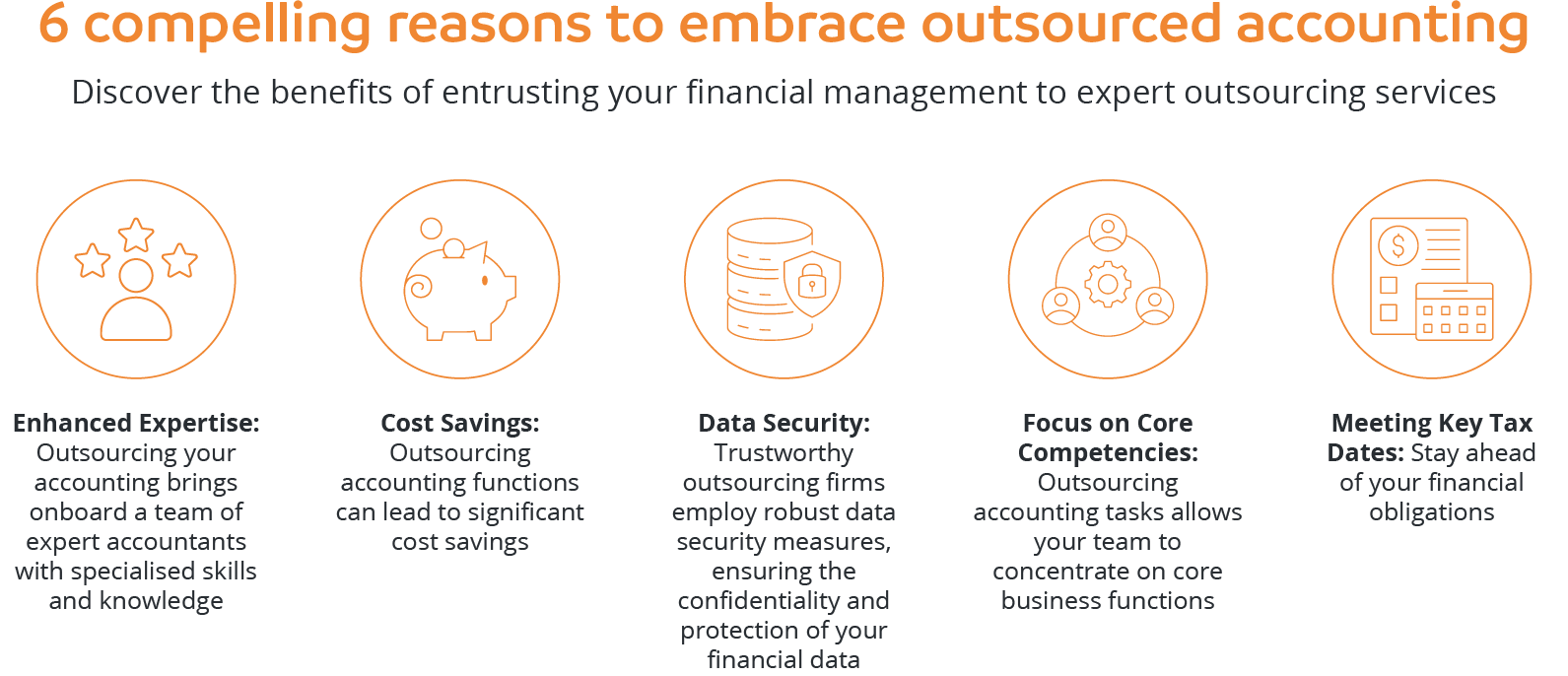

What are benefits of outsourcing accounting services?

Outsourcing accounting services can deliver a range of benefits including:

-

Sustainable growth:

excessive labor costs is one of the key hurdles for businesses wanting to achieve sustainable growth. Partnering with a quality outsourcing provider is more cost-effective than hiring an in-house accountant due to avoiding expenses associated with wages, office space, annual leave and equipment. -

Access to experts:

this benefit will particularly resonate with smaller businesses. By teaming with an outsourcing provider that specializes in accounting, they can tap into the minds and expertise of accounting professionals rather than trying to navigate the space on their own. This improves accuracy, ensures compliance and avoids the risk of penalties. -

Increased efficiency:

seeking external support with accounting allows organizations to spend more time on the tasks that make them unique, which is a surefire way to improve staff morale. It also puts the preparation of financial functions and statements in the hands of specialists, thus increasing efficiencies across the board. -

Scalability:

few things are more frustrating – or costly – for businesses than navigating staffing levels as demand goes up and down. Outsourcing makes this considerably easier as offshore partners take responsibility for increasing or decreasing numbers based on their clients’ needs. -

Access to technology:

working with an outsourcing partner allows businesses to access the latest accounting software solutions and tools without the costly outlay. Those partners also have systems that ensure processes are streamlined and tasks are automated to optimum levels.

Source: Finance And Accounting Business Process Outsourcing Market Size & Share, 2028 (kbvresearch.com)

How do you pursue an outsourced accounting strategy?

When embracing outsourcing, it is essential to take the right steps from the beginning. Here are five tips to hit the ground running.

-

Identify your needs:

accounting may include various functions but that does not mean they should all be outsourced. Take the time to pinpoint tasks that will benefit from external input, be it day-to-day assistance with accounts payable, bi-yearly tax assistance or ongoing financial advice. -

Set clear expectations:

ambiguity is a fast-track to outsourcing failure. To avoid confusion and wasted hours of work, clearly define expectations to your offshore partner and give them definitive direction about what is required. Like any relationship, communication is crucial. -

Seek a partner with similar values:

the best outsourcing partnerships are those where provider and clients exist on the same page. Consider site visits to assess an offshore partner’s cultural fit and communication skills as this will assist their ability to integrate with in-house teams and processes. -

Choose quality over cost:

in the rush to save costs, many businesses prioritize balance sheets when selecting an outsourcing partner. Rather than sacrificing quality, remember the long-term benefits that come from linking with experienced and highly qualified offshore providers. -

Remember security:

don’t make the mistake of blindly trusting the security credentials of your outsourcing provider. Check references, request certifications and investigate the likes of their network security measures, encryption methods and other data protection measures.

What staffing options are available for outsourced accounting teams?

Not every business requires the same level of support when it comes to outsourced accounting.

-

Junior:

less than a year of accounting experience with a relevant degree. Tasks completed could include journal entries, managing the accounts receivable or accounts payable ledgers and drafting financial statements. -

Intermediate:

one to three years of accounting experience. Tasks completed could include preparing budgeting forecasts, computing tax returns and ensuring timely payments. -

Senior:

more than three years of accounting experience. Tasks completed could include training junior accountants, providing financial advisory consultations, providing month-end KPI reports or updates to senior management teams and identifying improvements to accounting processes.

What are examples of an outsourced accounting team structure?

The size of one’s business and volume of work required will determine the size and structure of an outsourced accounting team.

A finance team in medium to large enterprises is typically formed in the following way, from a base level:

A finance team in a small business is typically formed in the following way:

What are tips for partnering with outsourced accounting providers in the Philippines?

The Philippines is among the world’s leading outsourcing destinations and not just because clients can save up to 70% on labor costs. The labor pool in the Philippines is known for its tech competency, attention to detail and operates in a fiscal and financial system almost identical to conditions in the West. In fact, the Philippines is one of the most dynamic economies in the East Asia region3, with sound economic fundamentals and a globally recognized competitive workforce.

When partnering with an outsourcing provider in the Philippines, remember:

- Offshore team members must know your business's systems and software to provide the best level of service for your business and clients.

- It is essential to communicate effectively and efficiently with your talent acquisition team in the Philippines. Be sure to let them know the job requirements, skills and qualifications you require of your ideal accounting staff. This will help the team source the right candidates, streamline the recruitment process and ultimately assist in finding the best fit candidates to meet your requirements.

- You can recruit as many accounting staff as required and even hire senior managers in the Philippines to oversee your offshore team. If and when you grow your offshore team, having one team lead can ensure streamlined communication and project updates are effectively delivered to your onshore team.

- It is easy to grow your offshore accounting team to suit your needs. It pays to start by initially adopting offshore roles that will give you the biggest returns and add more people as your business needs grow and change. If you’re not sure where to start, ask your provider to suggest a basic accounting team structure that has worked for similar clients.

Conclusion

Business owners tend to have many goals – sustainable growth, increasing efficiencies, allowing staff to spend more time on core tasks. Outsourcing accounting services is an ideal way to realize all these ambitions but it also does not just happen. While building a quality outsourcing partnership requires research, ongoing effort and quality communication, the good news is the rewards are definitely worth such commitment.

Half of tax professionals believe generative AI should be used for tax, accounting and audit work. Discover how to best leverage AI in accounting and finance, the challenges of adopting such technology and how it will impact jobs in the future.

Popular posts

Browse by topic

- Accounting

- Accounting & Finance

- All Industries

- Banking

- BPO/RPO/HRO

- Communication

- CSR & ESG

- Customer & Client Acquisition

- Customer Experience

- Cybersecurity

- Cybersecurity & Compliance

- Data Management

- Digital Operations

- Digital Transformation

- eCommerce

- Education

- Employee Engagement

- Engineering & Construction

- Financial Services

- Healthcare

- Hospitality and tourism

- HR & Recruitment

- Information Technology

- Insurance

- Legal Services

- Logistics

- Offshoring & Outsourcing

- Outsourcing

- Professional Services

- Real Estate

- Retail & eCommerce

- Startups

- Talent Acquisition and Retention

- Technology

- Trends & Guides

- Workforce Integration

Sign up for the offshoring eCourse

12 in-depth and educational modules delivered via email – for free

Related Resources

The complete guide to finance and accounting outsourcing services

Staying ahead often means embracing innovative strategies to streamline operations and maximize efficiency. Enter outsourcing: a game-changing..

Reasons to outsource accounting and bookkeeping services

On the first day of 2024, Financial Executives International (FEI) shared a disturbing statistic with its members – more than 300,000 accountants and..

Top 10 benefits of outsourcing accounting and payroll

Of all the departments within a business, accounting and payroll is probably one of the few areas where most of the work is repetitive and..